|

|

Serving Entrepreneurs & Investors since 2004

Enter subhead content here

southeast Angel investor, southeast private investor, angel investors, angel

investor groups, private equity investors, accredited investors, atlanta angel investors

atlanta investor, nbai, network of business angels and investors, launchfn, launch funding network, business capital, growth

capital, private equity, investor event

angel investor event, SE angel investor groups, se private investor groups

Hire the Experts

Raising early stage venture capital and angel investor capital can

be frustrating, take a long time and cost a lot of money if an entrepreneur doesn’t already know qualified investors

or have experience in connecting with small business investors and selling them on investing in their dream & vision.

That is why CEOs of the fastest growing, most promising early stage companies turn to LAUNCHfn for our expertise on business

strategy, capital formation strategies, and access to capital. Don't take our word for it....see it, hear it, read it here.

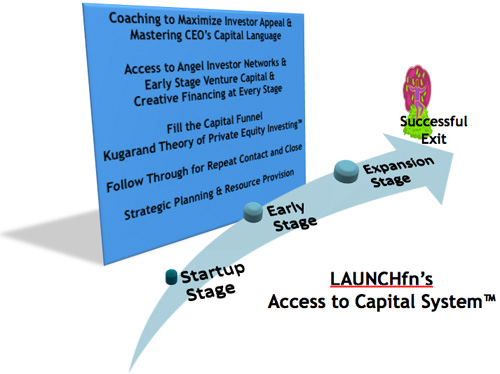

We have a step by step process that ensures your project will get the attention

it deserves. We recognize that you have passion and belief for your vision. We want to honor that by spending quality time

understanding your opportunity and helping you to formulate a capital strategy that will work and appeal to investors. Our

direct experience in working with capital investors of all types for over a decade uniquely qualifies us to save our clients

time and money in raising early stage capital, even in a tough economic climate. LAUNCHfn has developed the Access to Capital

System™ that provides a systematic approach to grow your confidence and increase your odds of success of getting the

money you need for your business, at whatever stage a business is in and from whatever industry sector.

|

|

STEP 1: Schedule

a call with an expert

During our an initial

consultation call, we will review your executive summary and provide initial feedback:

|

|

|

STEP 2: There are 3 options for you to

choose in Step 2:

Our resident expert, Karen Rands, will put her "investor hat

on" and review your business plan, investor presentation and/or other document submitted and analyze it for its potential

appeal to investors. A consultation call will be scheduled to provide directed one on one feedback on the overall impression

from an investor perspective. This is a necessary step before qualifying to pitch at any of our upcoming investor events

or to be accepted into our SEC compliant Access to Capital System. Fee: $197

for each document

"Just like going to the doctor for a “check up”, the Business Plan

Review and Capital Strategy Assessment is your company’s insurance policy to ensure your “readiness” to

meet with investors. Even if you believe you are "ready", if you have not raised at least $500,000 from outside

investors, you just can't know for sure that your business plan addresses the 4 questions it must answer for early stage capital

investors. You'll receive a full written report on your business plan's investor readiness from an independent business

analyst And a one on one consultation session with our resident expert, Karen Rands. We include your investor

presentation and private offering documents as part of our overall assessment. Fee: $497 Raising private or institutional capital is long and time consuming. If you have recently received

a contract or purchase order that is significantly larger than your current revenue or find yourself growing faster than you

can keep up with inventory demand, you may qualify for alternative financing. Through this application, we will assess

your potential for approval and connect contact potential lenders on your half to get tentative approval before moving forward.

Fee: $199 |

|

|

STEP 3: After you have finished Step

2, we’ll both know what your potential for success is when you enter our Access to Capital System™: During

any of the review and assessment sessions, we’ll discuss the costs to further engage LAUNCHfn and gain access to our

capital sources. We have spent over a decade identifying, qualifying and developing relationships with thousands of

investors – for startup, early stage and emerging growth companies, and hundreds of debt financing sources from traditional

to alternative lending. Depending on the type of capital we determine is appropriate for your stage and focus of your

business, you may have the opportunity to engage in a full SEC compliant capital raise with our investor relations partner

and SEC approved administrator, utilizing the secure due diligence investor portal on Kugarand Capital Holdings. This

is designed for companies seeking to raise capital through a REG D 506c or REG A+.

Visit

our Testimonial Page to read and listen to what our peers and clients say about working with LAUNCHfn. |

| |

|

RUN With the BIG DOGS Join our Facebook Community for Entrepreneurs and Investors that want to learn and apply the techniques

for building BIG Companies. Facebook.com/BusinessInvestorGrow The venture capital consulting services offered by LAUNCHfn covers advice, counsel, and connection with

all types of capital that an entrepreneur might need. Learn more by visiting our parent company: Kugarand Capital Holdings. To learn more about our growing national network of angel investors, please

visit the National Network of Angel Investors site. Please do not opt in on that site if you are not an investor.

|

If you haven't opted in to receive

our free investor tips for entrepreneurs: go here now: OPTIN Is your

company VentureWorthy? Wondering if you have what it takes to Raise

Capital in this tough environment? Find out how Investors will react to your company!

Wondering if you have what it takes to

Raise Capital in this tough environment?

Find out how Investors will react to your company!

Complete the Business Plan Review or Funding Application

Today so you don’t waste any more time or money trying to find angel investors and raise venture capital. What does Joel

Thompson, President of Sports Fan Products have to say about the business plan review process?

"The

business plan review was an extremely thorough examination of our business and its business plan. Through the assessment

process we were able to identify some issues within not only our plan, but our business model. With the

recommended changes, we were able to more thoroughly explain and expand upon key components of our company investors would

be most interested in reading. As a 10-year seasoned entrepreneur, I was amazed at the examination, vision and

assessment of the plan and received excellent advice I had never considered. For the entrepreneur who “knows everything

about your business (like me)”, then you owe it to yourself and your company to conduct and implement a full business

assessment from a smart objective team like Launch FN. Outstanding work. With the changes made to our plan

from the business assessment, we were able to successfully secure our private equity investment goal. THANKS!"

For more Testimonies from our peers and satisfied customers,click here

|

|

|